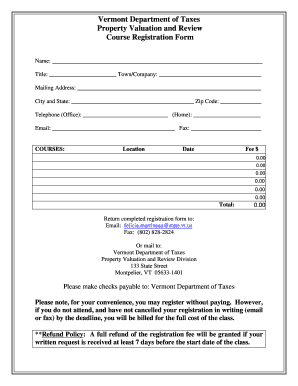

vermont department of taxes property valuation and review

State of Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 Agency of Administration wwwtaxvermontgov To. We Make Finding In-Depth Records For Vermont Easy.

Fy 2020 Tax Structure Explained Winners And Losers Vermont Business Magazine

The Division of Property Valuation and Review PVR of the Vermont Department of Taxes annually determines the equalized education property value EEPV and coefficient of.

. Vermont State Archives Records Administration. Ad Use Our Accurate Value Calculator to Get 5 Free Property Estimates Now. A property tax is a levy on property that the owner is required to pay with rates set as a percentage of the home value.

State of Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 Agency of Administration wwwtaxvermontgov To. 802-828-5860 - Taxpayer Services Division. Honorable Shap Smith Speaker of.

Property Valuation Review and Annual Reports. - Property Valuation Review Division. Receive a Free Detailed Analysis of Your Property Value.

Elections Campaign Finance. A Guide for Vermont Listers and Assessors Published by the Division of Property Valuation and Review Vermont Department of Taxes Phone. Introduction to the Use Value Appraisal UVACurrent Use Program.

Chapter 124 allows eligible forest or. Use Value Appraisal Program UVA also known as Current Use 32 VSA. Showing 1 to 10 of 10 entries.

Vermonts UVA Program enables eligible private landowners who practice long-term forestry or agriculture to have their land appraised based on the propertys value of production of wood or. Property assessments include two components-the. Ad View Property History For Vermont Before You Buy.

Uncover Available Property Tax Data By Searching Any Address. Honorable Shap Smith Speaker of the House. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions.

PVR Annual Report - Based on 2020 Grand List Data.

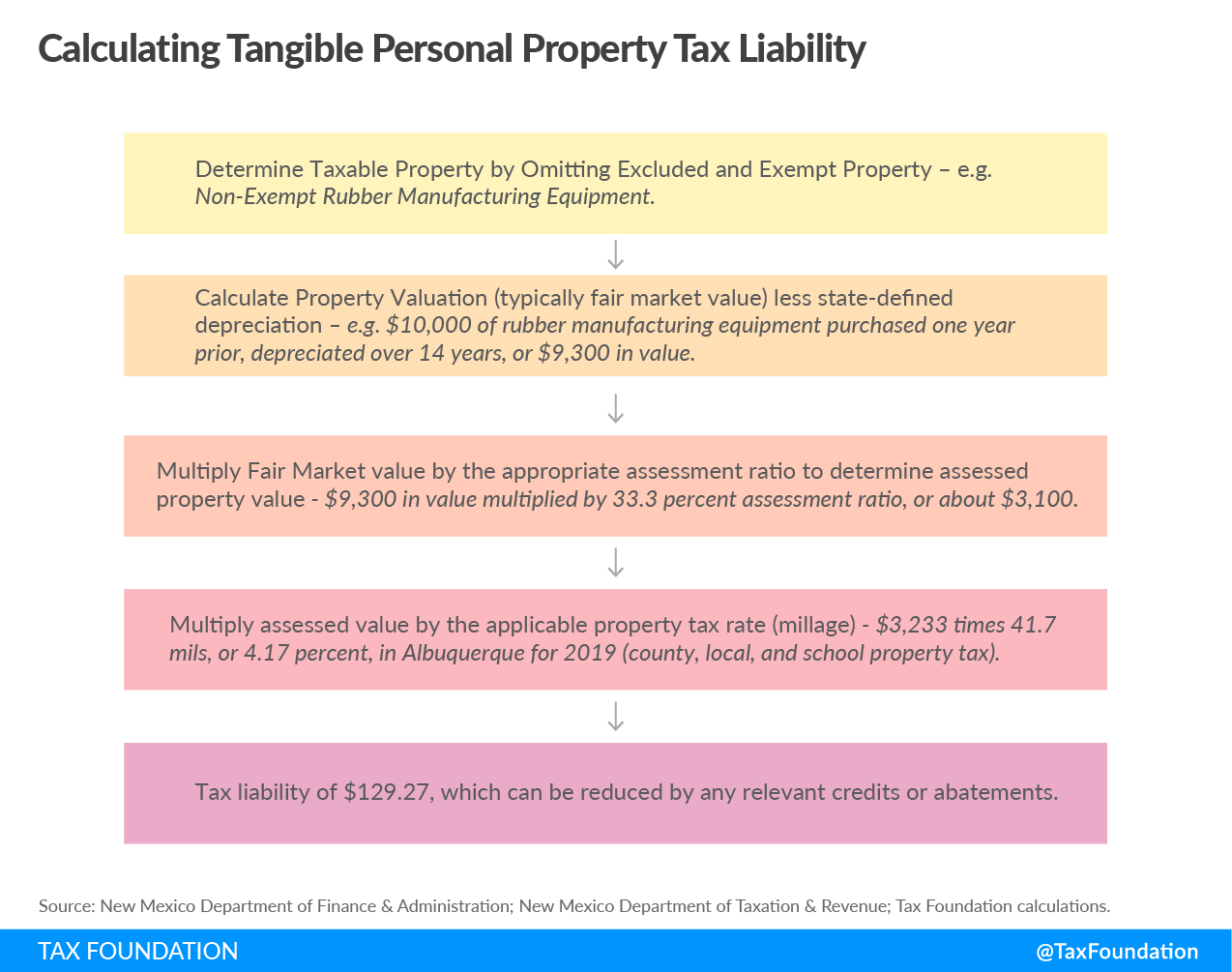

Tangible Personal Property State Tangible Personal Property Taxes

As Burlington Finalizes New Property Values Some Residents Still Aren T Satisfied City Seven Days Vermont S Independent Voice

Kate S Assistant Director Of Property Valuation And Review State Of Vermont Linkedin

Burlington S Property Reassessment Has Set Record High Values What S The Cost To Residents City Seven Days Vermont S Independent Voice

Publications Department Of Taxes

Publications Department Of Taxes

Publications Department Of Taxes

Publications Department Of Taxes

Fy 2020 Tax Structure Explained Winners And Losers Vermont Business Magazine

Town Officer Education Conference Uvm Extension Cultivating Healthy Communities The University Of Vermont

How An Education Fund Shortfall Could Impact Vermont Taxpayers

Town Officer Education Conference Uvm Extension Cultivating Healthy Communities The University Of Vermont

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

Home Valuation Form Fill Online Printable Fillable Blank Pdffiller

Publications Department Of Taxes

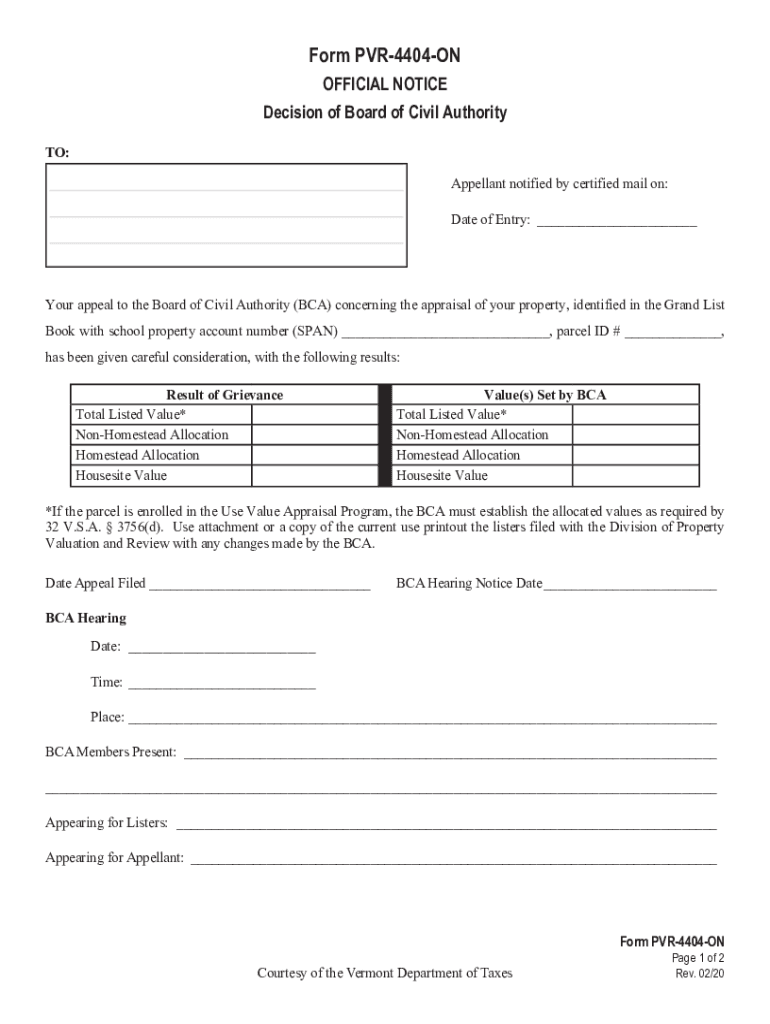

Vt Form Pvr 4404 On Formerly Pvr 4404a 2020 2022 Fill Out Tax Template Online Us Legal Forms

Appeal Property Tax Assessment In Vt Msk Attorneys

Tax Burdened Residents Bear The Brunt Of Burlington S First Property Reassessment In 16 Years City Seven Days Vermont S Independent Voice

Preferential Property Tax Programs In Connecticut And Vermont